Vital Statistics:

| Last | Change | |

| S&P Futures | 2284.3 | 10.0 |

| Eurostoxx Index | 366.3 | 4.4 |

| Oil (WTI) | 52.8 | -0.4 |

| US dollar index | 91.1 | 0.0 |

| 10 Year Govt Bond Yield | 2.49% | |

| Current Coupon Fannie Mae TBA | 102.1 | |

| Current Coupon Ginnie Mae TBA | 103.2 | |

| 30 Year Fixed Rate Mortgage | 4.16 |

Global stocks are rallying on no real news. The Dow hit 20,000 this morning (CNBC is probably breaking out the champagne as we speak) Bonds and MBS are down on the “risk on” trade.

Mortgage applications increased 4% last week as purchases rose 6% and refis rose 0.2%. This is a 7 month high for purchases.

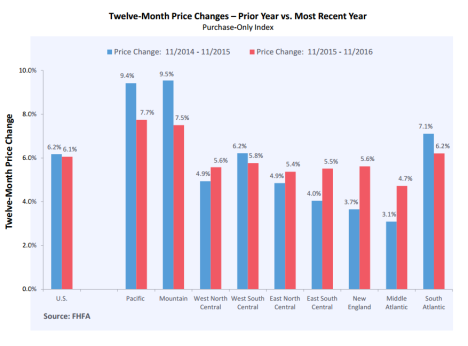

Home prices increased 0.5% in November, and are up 6.1% YOY, according to the FHFA House Price Index. Geographically, the Pacific and Mountain states continue to lead the way, while the East Coast lags, however prices are decelerating out West and accelerating in the East. Prices have more than recouped the losses from the bubble years and are hitting new highs.

Further slicing and dicing the home price data, the luxury end of the market continues to lag, while the lower price points are accelerating. Know where is getting killed in this segment? Washington DC. This shift makes sense as the Millennial generation is beginning to reach the family-forming stage and needs starter homes. Starter homes should be a fertile area for the builders over the next decade or so. We are even beginning to see a reduction in the NIMBY-ism in places like California, which face acute housing shortages.

Treasury Secretary Steve Mnuchin supports an independent central bank and is not a member of the “audit the Fed” crowd. Congressional Republicans have been pushing for more Congressional oversight of monetary policy, however independence from politicians is critical for the Fed to do its job. Politicizing the Fed is a recipe for inflation because no politician likes a recession and sometimes they are necessary to suppress inflation. In fact, the last time Congress got involved with monetary policy was the dual mandate, which requires the Fed to minimize unemployment while controlling inflation. Sounds like a reasonable policy, however in practice it has resulted in asset bubble after asset bubble.

House flipping is back to bubble-era levels. Home flippers accounted for 6.1% of sales in 2016, the highest level since 2006 when the number hit 7.3% of sales. Scarce inventory is making a good environment for house flipping, with strong home price appreciation. Eventually builders will begin to meet this demand, however for the moment, home price gambling is a big trade in places like Las Vegas.

Donald Trump met with automotive CEOs yesterday to talk about regulation and bringing jobs back to the US. He cited environmental regulations as a big disincentive to manufacture in the US. Note that there are currently about 300,000 regulations controlling manufacturing in the US. Separately, Trump allowed the permitting process for the Keystone XL and Dakota Access pipelines to begin again.

Filed under: Economy, Morning Report | 38 Comments »